Kristi Barens, Principal at Mullin Barens Sanford Financial, says that success in the insurance industry requires preparation, mentorship, and the right mindset. Kristi is now a powerful force in the executive benefits industry and a founding partner at her firm, yet when she chose to move from a Senior Manager to an Advisor role almost 20 years ago, she had concerns about leaving a comfortable salary for a commission-only job.

Kristi Barens, Principal at Mullin Barens Sanford Financial, says that success in the insurance industry requires preparation, mentorship, and the right mindset. Kristi is now a powerful force in the executive benefits industry and a founding partner at her firm, yet when she chose to move from a Senior Manager to an Advisor role almost 20 years ago, she had concerns about leaving a comfortable salary for a commission-only job.

Kristi shared her concerns with her mentor Peter Mullin. “Peter, who is a legend in the industry, told me that he never saw himself as a salesperson, but as a consultant,” she said. “He told me, ‘As long as you are an expert in your subject and give clients good advice, then they’re going to work with you.’”

This encouragement enabled Kristi to shift her mindset and understand the value of her services. “I was afraid of being a salesperson,” she said, “but I was never afraid of giving clients good advice.”

The Journey from Analyst to Partner

Kristi always had a love of numbers and sought a job after college where she could showcase her passion. “I was really looking for something where I could use my technical math and financial skills to work with clients,” she said. “So I answered a job ad in the L.A. Times for an Analyst position with MCG LA – later known as MullinTBG.”

She spent the next decade learning the business from the ground up. “I had a fabulous experience working with a great group of people who were mentors and trained me in this business,” she recalls. But after 11 years behind the scenes, Kristi was ready for something different. Her desire to spend more time connecting with clients and less managing people prompted her to approach Peter Mullin about changing roles.

“I want to be out with clients. I want to be a consultant,” she told him. “Can you help me make this transition?” Peter agreed to help, and Kristi has never looked back. “I determine my compensation. It just depends on how hard my team and I want to work.” she said.

Along with the exceptional financial opportunity, Kristi loves the work that she now does. “I’m working with companies to create tax efficient retirement savings opportunities for their key employees, and then helping those individuals understand how the plans work so they can utilize them effectively.”

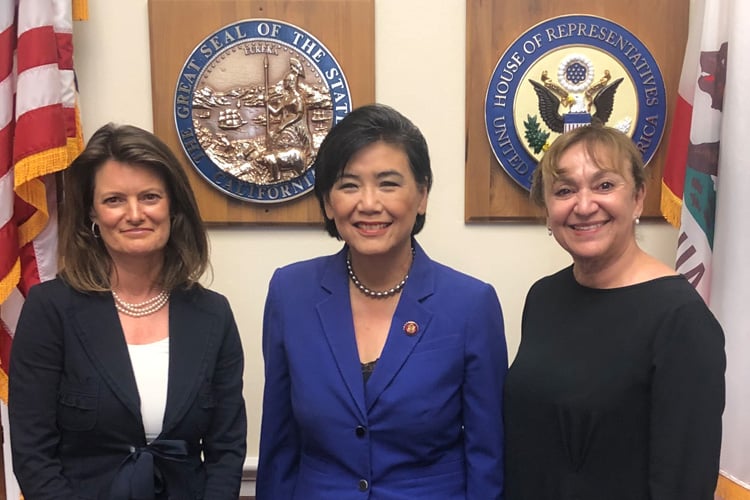

Members of the AALU Board of Directors Kristi Barens and Marguerite Rangel meet with Congresswoman Judy Chu in Washington D.C.

Being a Woman in the Industry Has Served Kristi Well

Throughout her career, Kristi has seen the insurance industry employ a lot of women in the back office, but not many in sales. “I think it is a great business for women,” she said. “And there are not enough in it.” Kristi added that many of the decision-makers and key buyers she meets in her line of work are women.

Kristi believes that being a woman in a male-dominated industry gives her an edge. “First of all, just because I am a woman, I’m different,” she said. “It’s harder to view me as just another salesperson, which is a huge advantage.” She also believes that many women could thrive in this field with the proper mentorship, coaching and assistance with the transition from employee to sales/consulting.

Breaking Down Barriers

Fortunately, the insurance industry is changing. Kristi credits her success to hard work, a willingness to take risks, and having a strong mentor to guide her through the process. Her advice to other women interested in insurance? “Make sure you get involved with a firm where you have access to a mentor.”

M’s Magnet Program for Financial Advisors offers exactly that kind of support. The two-year program gives high achievers who want to be in control of their careers the opportunity to work with mentors who are personally invested in their success. Plus, the Magnet Program’s compensation package includes salary, commissions, and bonus opportunities, removing the risk that often acts as a barrier to the opportunity for women.

If you have the skills and desire to take control of your success, you should investigate the Magnet Program.